cook county unpaid taxes

Records for delinquent taxes for prior years currently defined as tax year 2007 and earlier are the responsibility. Contact AppealTax today to discuss your Association residential or commercial property tax appeal.

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

Those lots have unpaid taxes attached to them and according to Cook County Treasurer Maria Pappas it adds up to 5 billion in lost property tax revenue.

. This Tax Sale is for delinquent property taxes from Tax Year 2019 which were due in two installments in 2020. The 2022 Scavenger Sale includes 31209 property index numbers or PINs with 14598 of them in the City of Chicago and 16611 in suburban Cook County. The Cook County Treasurer sends property tax bills collects property tax revenue and distributes it to taxing districts to fund services like schools.

And we only charge a small portion of the overall tax savings secured. Cook County Treasurer Maria Pappas changes 2022 Scavenger Sale to benefit bidders and communities. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property.

If you have delinquent taxes for Tax Year 2019 they will be offered at the 2019 Annual Tax Sale which begins May 12 2022. Use your Property Index Number PIN to see if your property has any sold forfeited or open taxes. Out of the 31209 parcels originally offered by the Cook County Treasurer data obtained by Chicago Cityscape found that 5180 properties were bid on by the private market.

Ad Search Tax Relief Associates. The Longer You Ignore Unpaid Taxes The Worse it Gets. May 9 2022.

Visit Our Website Today Get Records Fast. To verify ownership of a piece of property if a property has foreclosed or if there is a lien on a property you must contact the Cook County Recorder of Deeds Office at 312-603-5050. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property.

The unpaid taxes on those properties totals almost 115 billion countywide including 2549 million just in Chicago and adds to the financial challenges many communities face. The Cook County Treasurers Office mails tax bills and collects payments. The Cook County Land Bank Authority is barred from putting in a claim on occupied property but it did so for Josephines Cooking and held onto it.

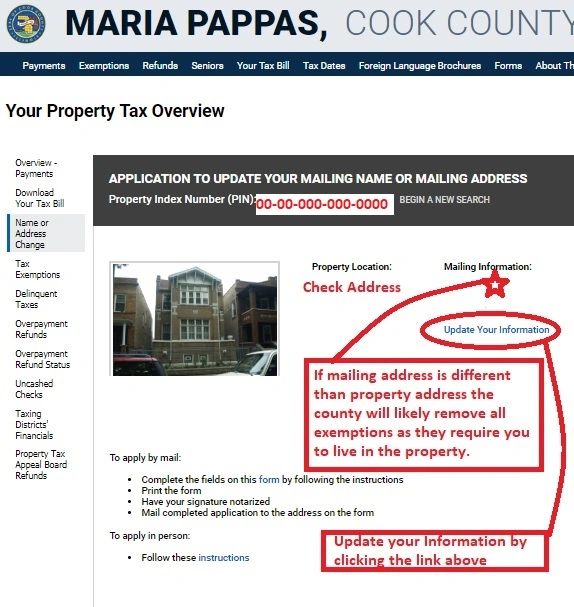

Cook County Treasurer Maria Pappas will conduct the annual sale of delinquent property taxes from May 12 18 2022. Just Enter Name and State. COOK COUNTY TREASURER Payments Exemptions Refunds Seniors Your Tax Bill Tax and Scavenger Sales Foreign Language Brochures.

The Clerks Tax Extension Unit is responsible for calculating property tax rates for all local taxing districts in Cook County. Gain Quick Access To The Records You Need In Any City. We Can Help Suspend Collections Liens Levies Wage Garnishments.

The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act and the Americans with Disabilities Act. The last five tax sales tax years 2014 back to 2010 have generated nearly 365 million for the county. Certified notice out on 45000 properties with unpaid taxes in Cook County.

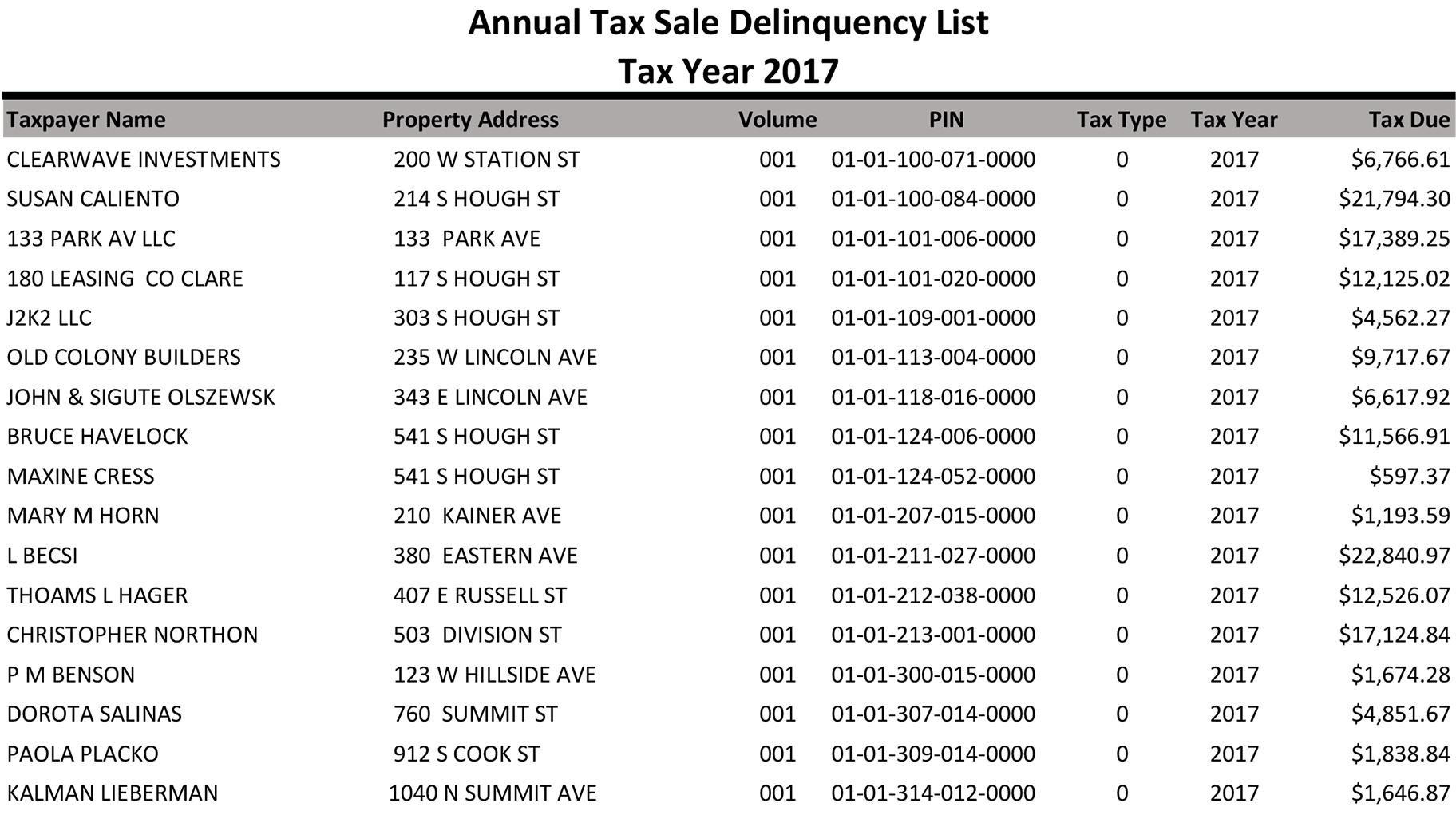

Any unpaid balance due may then be subject to sale to a third party. Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all. CHICAGO March 23 2022 PRNewswire -- On May 12 2022 Cook County Treasurer Maria Pappas will begin the sale of unpaid 2019 property taxes that were originally due in 2020.

Select a tab for detailed lists of properties with delinquent taxes for Tax Year 2020 payable in 2021 that are currently eligible for the Annual Tax Sale that is scheduled for November 2022. Cook County Plans To Sell 37000 Properties With Delinquent Tax Bills - Chicago IL - More than 37000 properties will be part of Cook Countys Tax Sale running from May 12. Search By Property Index Number PIN.

Find the lowest price for Tax Relief Associates today. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. For 2019 2020.

According to data from Cook County Treasurer Maria Pappas landlords have yet to pay about 6 percent of commercial property taxes that were originally due last August with late fees waived. If your unpaid taxes have been sold the Clerks office can provide you with an Estimate of the Cost of Redemption. We Can Help With The IRS.

If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with. In fact this weeks tax sale totals 130 million in unpaid taxes for the year 2015. To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer.

Clark Street Suite 1160 Chicago IL 60602 or at over 100 participating. While taxes from the 2021 second installment tax bill which reflect 2020 assessments are usually due in August the due date was postponed until October 1st. The Clerks office also provides calculations of delinquent taxes owed.

The 2021 tax bills will mail on September 1st. The Cook County Clerk assumes no liability for any damages incurred. Since 2015 weve saved Illinois property owners over 100 million in reduced property taxes.

The CURRENT 20202021 VEHICLE LICENSE PAYMENT can still be remitted online by mail in-person at the Cook County Department of Revenue located at 118 N. The May 8 Tax Sale is for homes businesses and land with unpaid bills for Tax Year 2018 which was originally due in 2019. 20202021 Wheel Tax Vehicle License Information To pay your 20202021 Wheel Tax liability please scroll to the bottom of the screen and click on the payment button.

Report a correction or typo Related topics. When delinquent or unpaid taxes are sold by the Cook County Treasurers office the Clerks office handles the redemption process which allows taxpayers to redeem or pay their taxes to remove the risk of losing their property. Ad Find All The Records You Need In One Place.

PIN in the search box below. Save now at Shopwebly. Approximately 1756 million in unpaid 2019 property taxes are overdue on 37176 properties in Cook County.

The Cook County Land Bank Authority participated in the 2022 Cook County Scavenger Sale which was conducted from February 14 th March 3rd 2022.

Cook County To Sell Off Tax Delinquent Properties To Highest Bidders Chicago News Wttw

Cook County Tax Sale Begins On May 12 Chicago Association Of Realtors

33rd Ward Newsletter Oct 8 14 2021 Rossana Rodriguez

A Look Into The Early Resolution Program Carpls

Badillo Law Group P C If You Receive A Letter That Looks Like This Is Or Similar To This Ignore It It Is A Scam There Is No Such Thing As A

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

Austintalks 30 000 Plus Properties In Cook County S First Tax Sale In More Than 2 Years Austintalks

Scavenger Sale Study Public Convening July 19 2021 Youtube

Cook County Treasurer Maria Pappas Offers Help With Property Tax Problems Village Of Bellwood